DeepAnalyze: Agentic Large Language Models for Autonomous Data Science

Abstract

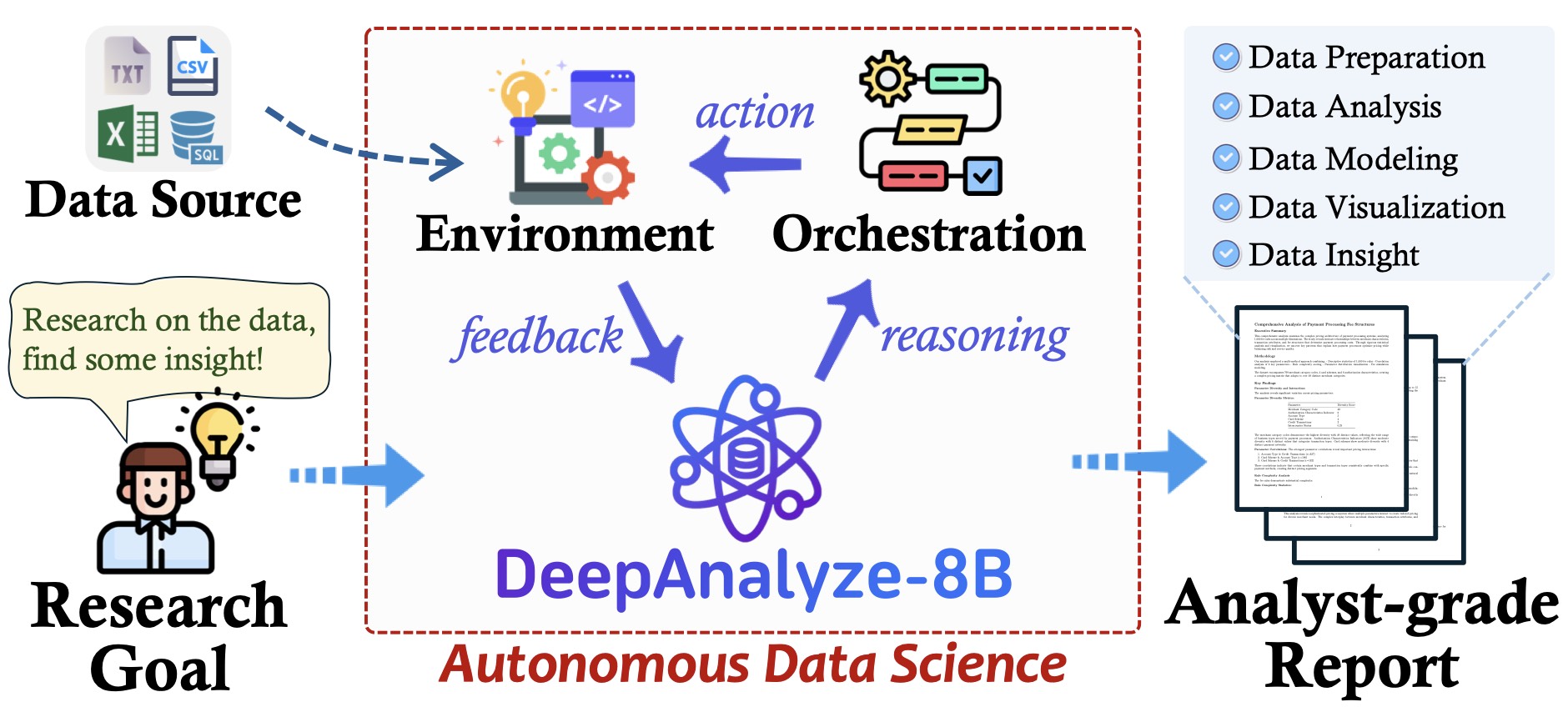

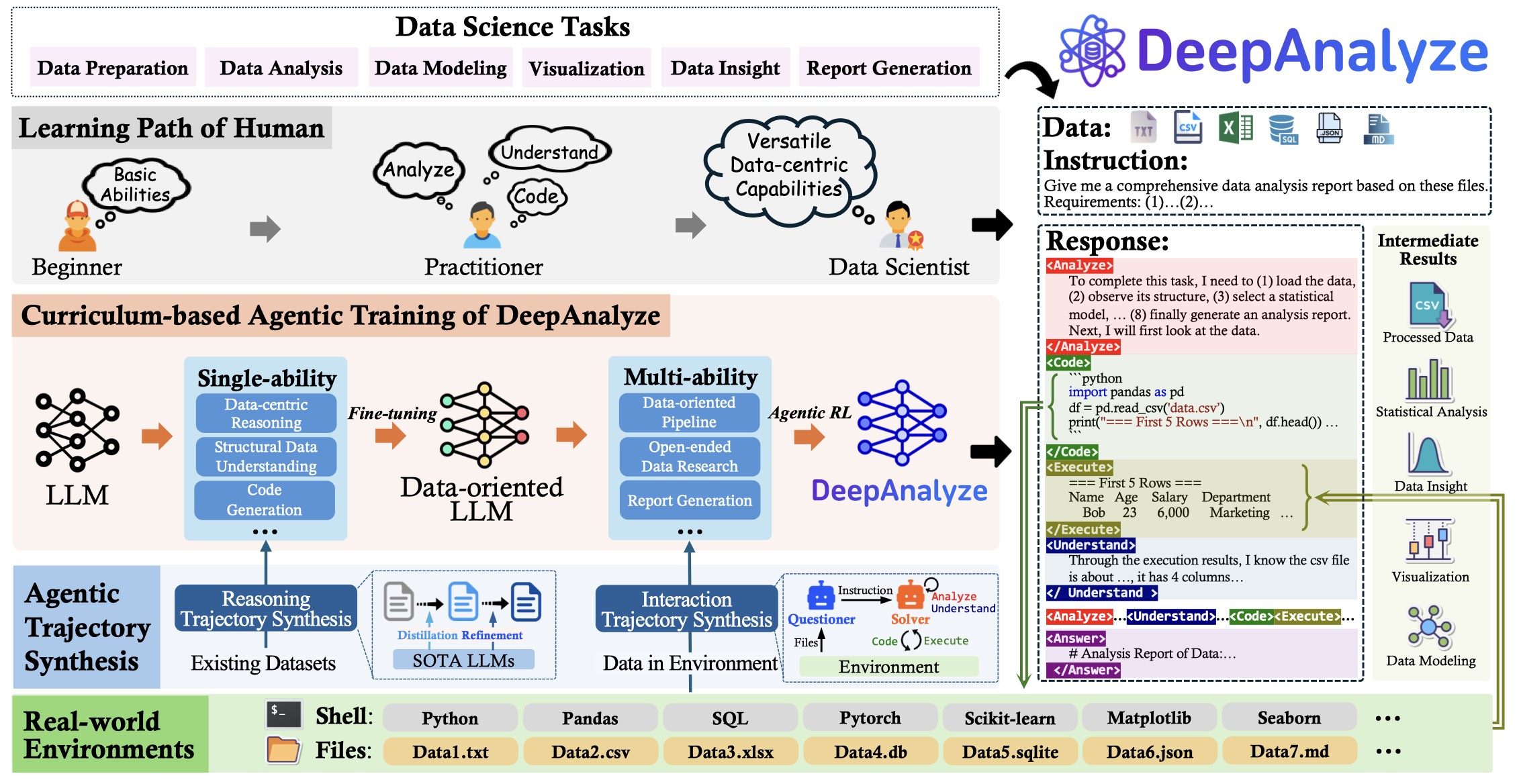

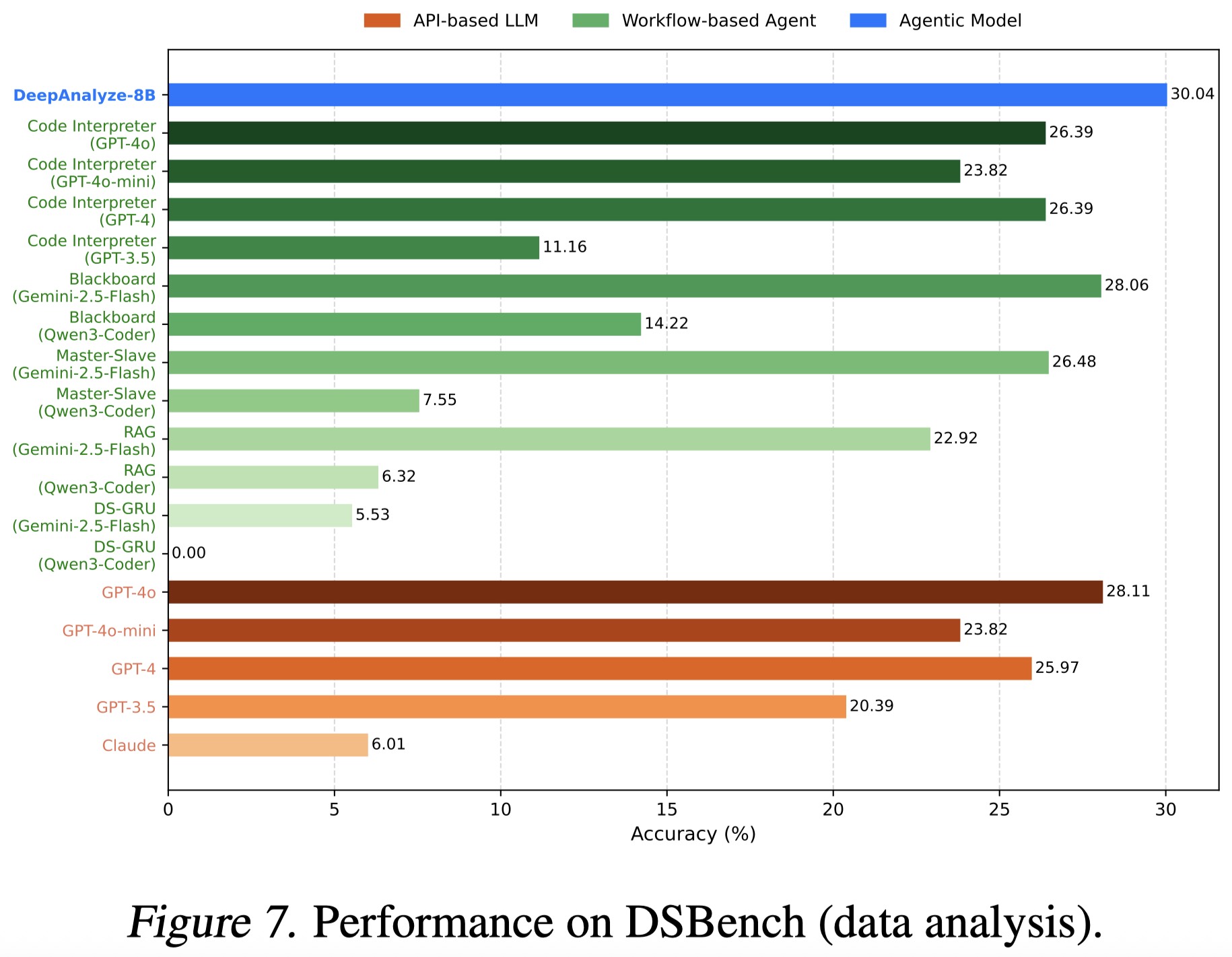

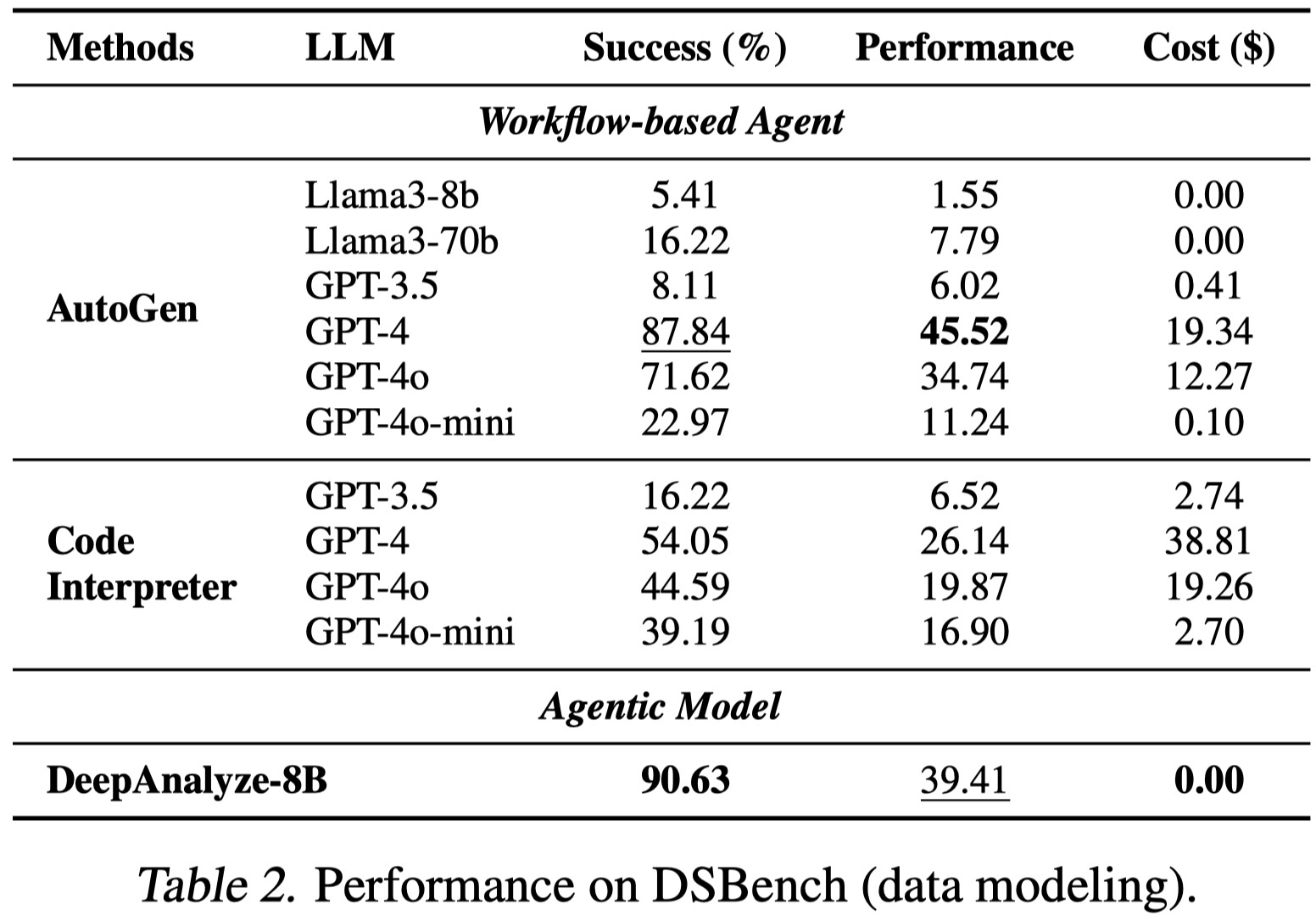

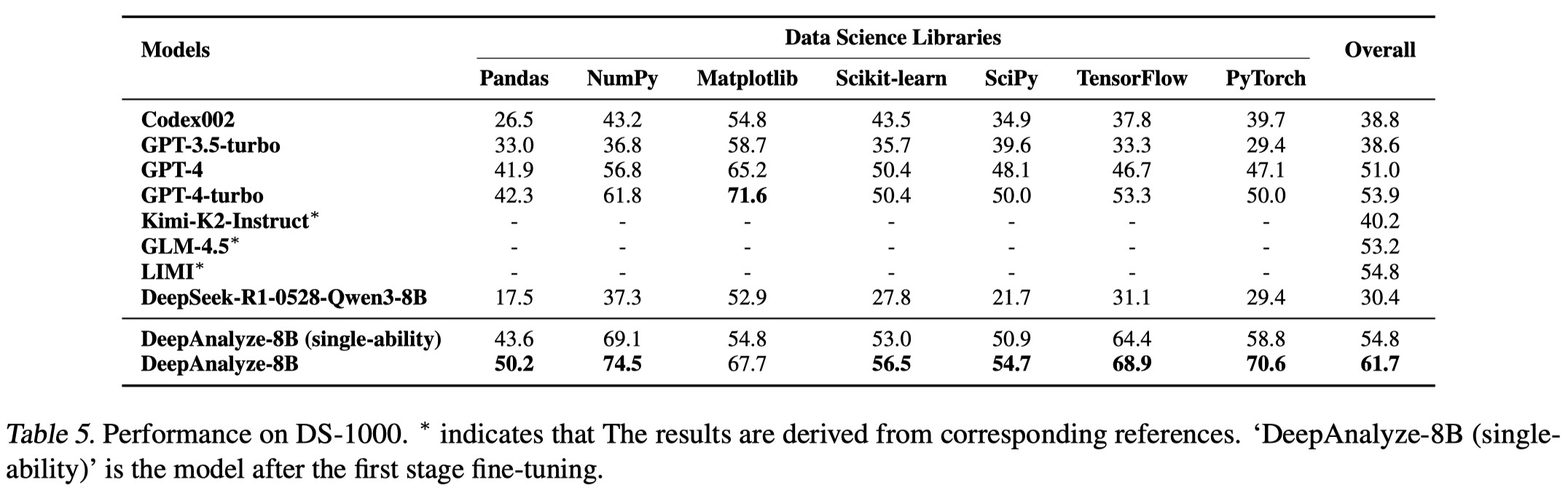

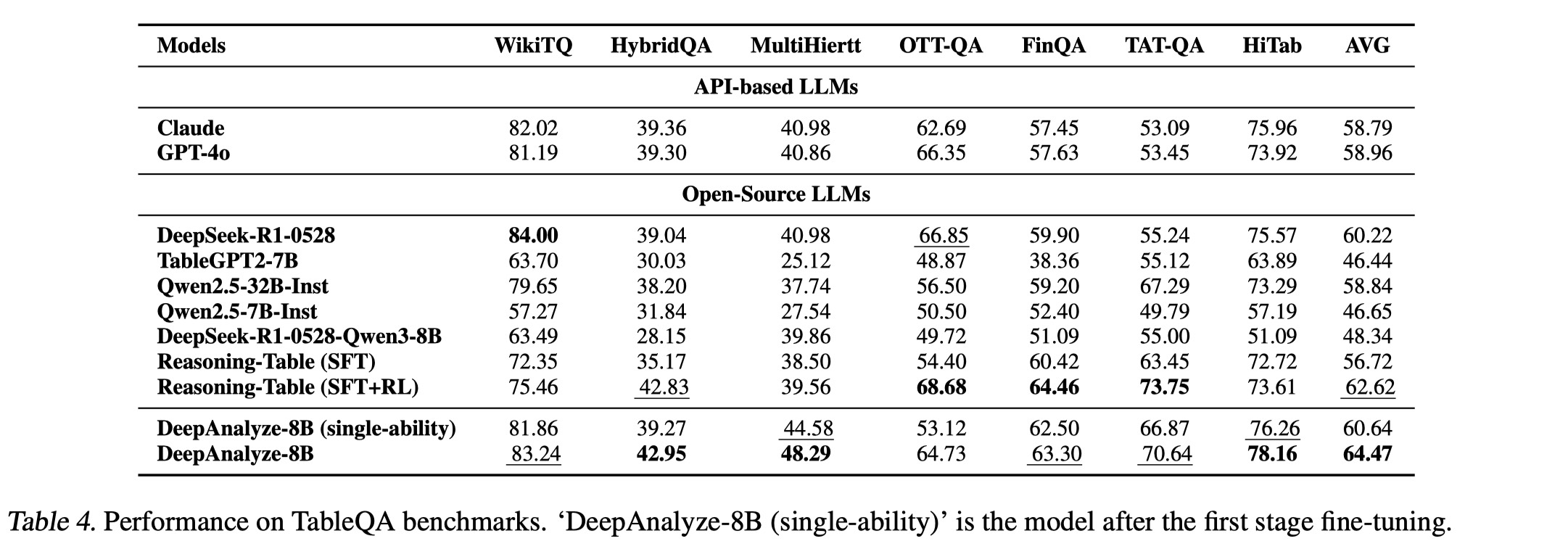

Autonomous data science, from raw data sources to analyst-grade deep research reports, has been a long-standing challenge, and is now becoming feasible with the emergence of powerful large language models (LLMs). Recent workflow-based data agents have shown promising results on specific data tasks but remain fundamentally limited in achieving fully autonomous data science due to their reliance on predefined workflows. In this paper, we introduce DeepAnalyze-8B, the first agentic LLM designed for autonomous data science, capable of automatically completing the end-toend pipeline from data sources to analyst-grade deep research reports. To tackle high-complexity data science tasks, we propose a curriculum-based agentic training paradigm that emulates the learning trajectory of human data scientists, enabling LLMs to progressively acquire and integrate multiple capabilities in real-world environments. We also introduce a data-grounded trajectory synthesis framework that constructs high-quality training data. Through agentic training, DeepAnalyze learns to perform a broad spectrum of data tasks, ranging from data question answering and specialized analytical tasks to open-ended data research. Experiments demonstrate that, with only 8B parameters, DeepAnalyze outperforms previous workflow-based agents built on most advanced proprietary LLMs. The model, code, and training data of DeepAnalyze are open-sourced, paving the way toward autonomous data science.

Introducing DeepAnalyze

DeepAnalyze automates the entire data science pipeline, such as specific data tasks and open-ended data research, offering a “one-size-fits-all” solution for data science tasks.

To achieve this, we propose:

- Curriculum-based agentic training: Guide LLM from mastering individual single abilities to developing comprehensive abilities in real-world environments through a progressive easy-to-difficult schedule.

- Data-grounded trajectory synthesis: Automatically generates high-quality reasoning and interaction trajectories to provide effective guidance within the vast solution space.

More details refer to DeepAnalyze's paper.

DeepAnalyze Deep Research Cases

- Case 1

- Case 2

- Case 3

- Case 4

- Case 5

- Case 6

- Case 7

- Case 8

- Case 9

- Case 10

- Case 11

- Case 12

- Case 13

- Case 14

- Case 15

- Case 16

- Case 17

- Case 18

- Case 19

- Case 20

- Case 21

- Case 22

- Case 23

- Case 24

- Case 25

- Case 26

- Case 27

- Case 28

- Case 29

- Case 30

- Case 31

- Case 32

- Case 33

- Case 34

- Case 35

- Case 36

- Case 37

- Case 38

- Case 39

- Case 40

- Case 41

- Case 42

- Case 43

- Case 44

- Case 45

- Case 46

- Case 47

- Case 48

- Case 49

- Case 50

- Case 51

- Case 52

- Case 53

- Case 54

- Case 55

- Case 56

- Case 57

- Case 58

- Case 59

- Case 60

- Case 61

- Case 62

- Case 63

- Case 64

- Case 65

- Case 66

- Case 67

- Case 68

- Case 69

- Case 70

- Case 71

- Case 72

- Case 73

- Case 74

- Case 75

- Case 76

- Case 77

- Case 78

- Case 79

- Case 80

- Case 81

- Case 82

- Case 83

- Case 84

- Case 85

- Case 86

- Case 87

- Case 88

- Case 89

- Case 90

- Case 91

- Case 92

- Case 93

- Case 94

- Case 95

- Case 96

- Case 97

- Case 98

- Case 99

- Case 100

Instruction:

Analyze the payment processing dataset to prepare it for fee optimization analysis. Your task is to research and document the methodology for merging transaction data from payments.csv with fee rules from fees.json, merchant metadata from merchant_data.json, and reference data from acquirer_countries.csv and merchant_category_codes.csv. The report should outline strategies for handling complex conditional fee calculations, resolving data inconsistencies across sources, and creating a unified dataset suitable for identifying cost-saving opportunities through optimal acquirer selection and transaction routing.

DeepAnalyze:

import pandas as pd

import json

# First examine the payments.csv structure

print("=== Payments Data Structure ===")

payments_sample = pd.read_csv('payments.csv', nrows=5)

print("Sample rows:")

print(payments_sample.head(2))

print("\nColumns:", list(payments_sample.columns))

print("\nData types:")

print(payments_sample.dtypes)

# Check file sizes and basic stats

file_sizes = {

'payments.csv': 23028.7,

'fees.json': 518.7,

'merchant_data.json': 6.7,

'acquirer_countries.csv': 0.2,

'merchant_category_codes.csv': 26.0

}

print("\nFile sizes (KB):")

for file, size in file_sizes.items():

print(f"{file}: {size:.1f}")

# Examine fees.json structure

print("\n=== Fees Data Structure ===")

with open('fees.json', 'r') as f:

fees_data = json.load(f)

print(f"Number of fee rules: {len(fees_data)}")

print("First fee rule structure:")

print(json.dumps(fees_data[0], indent=2))

# Check merchant_data.json

print("\n=== Merchant Data Structure ===")

with open('merchant_data.json', 'r') as f:

merchant_data = json.load(f)

print(f"Number of merchants: {len(merchant_data)}")

print("Sample merchant record:")

print(json.dumps(merchant_data[0], indent=2))

# Check reference files

print("\n=== Reference Data Samples ===")

acquirer_countries = pd.read_csv('acquirer_countries.csv')

print("\nAcquirer Countries:")

print(acquirer_countries.head(2))

print("\nColumns:", list(acquirer_countries.columns))

mcc_data = pd.read_csv('merchant_category_codes.csv')

print("\nMerchant Category Codes:")

print(mcc_data.head(2))

print("\nColumns:", list(mcc_data.columns))

import pandas as pd

import json

from datetime import datetime

# Load core datasets

payments = pd.read_csv('payments.csv', usecols=[

'psp_reference', 'merchant', 'card_scheme', 'is_credit',

'eur_amount', 'issuing_country', 'acquirer_country', 'aci'

])

with open('fees.json') as f:

fee_rules = json.load(f)

with open('merchant_data.json') as f:

merchant_data = json.load(f)

acquirer_countries = pd.read_csv('acquirer_countries.csv')

mcc_data = pd.read_csv('merchant_category_codes.csv')

# Create merchant attribute mapping

merchant_attrs = pd.DataFrame(merchant_data)

merchant_map = merchant_attrs.set_index('merchant').to_dict('index')

# Process acquirer countries

acquirer_country_map = dict(zip(acquirer_countries['acquirer'],

acquirer_countries['country_code']))

# Fee rule evaluation function

def matches_rule(transaction, merchant, rule):

"""Check if transaction matches a fee rule"""

# Card scheme match

if rule['card_scheme'] and transaction['card_scheme'] != rule['card_scheme']:

return False

# Account type match

if rule['account_type'] and merchant['account_type'] not in rule['account_type']:

return False

# Merchant category match

if rule['merchant_category_code'] and merchant['merchant_category_code'] not in rule['merchant_category_code']:

return False

# ACI match

if rule['aci'] and transaction['aci'] not in rule['aci']:

return False

# Intracountry check

if rule['intracountry'] is not None:

is_intracountry = transaction['issuing_country'] == transaction['acquirer_country']

if rule['intracountry'] != is_intracountry:

return False

return True

# Test with sample transaction

sample_txn = payments.iloc[0].to_dict()

sample_merchant = merchant_map[sample_txn['merchant']]

print("\nSample Transaction Fee Matching:")

for rule in fee_rules[:3]:

if matches_rule(sample_txn, sample_merchant, rule):

print(f"Rule {rule['ID']} applies")

# Create initial merged dataset (sample)

print("\nCreating merged dataset sample...")

payments['merchant_attr'] = payments['merchant'].map(merchant_map)

payments['acquirer_country_code'] = payments['acquirer_country'].map(acquirer_country_map)

# Show merged structure

print("\nMerged Data Structure:")

print(payments[['psp_reference', 'merchant', 'card_scheme', 'acquirer_country_code']].head(2))

import pandas as pd

import numpy as np

from datetime import datetime

# Load data with optimized dtypes

payments = pd.read_csv('payments.csv', usecols=[

'psp_reference', 'merchant', 'card_scheme', 'is_credit',

'eur_amount', 'issuing_country', 'acquirer_country', 'aci', 'year', 'day_of_year'

], dtype={

'psp_reference': 'int64',

'merchant': 'category',

'card_scheme': 'category',

'is_credit': 'bool',

'eur_amount': 'float32',

'issuing_country': 'category',

'acquirer_country': 'category',

'aci': 'category',

'year': 'int16',

'day_of_year': 'int16'

})

# Load reference data

with open('fees.json') as f:

fee_rules = json.load(f)

with open('merchant_data.json') as f:

merchant_data = json.load(f)

acquirer_countries = pd.read_csv('acquirer_countries.csv')

# Create optimized mappings

merchant_map = pd.Series(merchant_data).to_dict('index')

acquirer_country_map = dict(zip(acquirer_countries['acquirer'],

acquirer_countries['country_code']))

# Enhanced fee rule matching with null handling

def rule_applies(rule, transaction, merchant):

"""Improved rule matching with null handling"""

# Card scheme check

if rule.get('card_scheme') and transaction['card_scheme'] != rule['card_scheme']:

return False

# Account type check (empty list means apply to all)

if rule.get('account_type') and merchant.get('account_type') not in rule['account_type']:

return False

# Merchant category check

if rule.get('merchant_category_code') and merchant.get('merchant_category_code') not in rule['merchant_category_code']:

return False

# ACI check

if rule.get('aci') and transaction['aci'] not in rule['aci']:

return False

# Intracountry check

if rule.get('intracountry') is not None:

is_intracountry = transaction['issuing_country'] == transaction['acquirer_country']

if rule['intracountry'] != is_intracountry:

return False

return True

# Pre-filter rules by common attributes

card_scheme_rules = {r['ID'] for r in fee_rules if not r.get('card_scheme')}

account_type_rules = {}

for r in fee_rules:

at = r.get('account_type')

account_type_rules[at] = account_type_rules.get(at, []) + [r['ID']]

# Sample processing function

def process_batch(transactions, merchant_map):

results = []

for _, txn in transactions.iterrows():

merchant = merchant_map.get(txn['merchant'])

if not merchant:

continue

applicable_rules = []

for rule_id in card_scheme_rules:

rule = next((r for r in fee_rules if r['ID'] == rule_id), None)

if rule and rule_applies(rule, txn, merchant):

applicable_rules.append(rule)

results.append({

'psp_reference': txn['psp_reference'],

'applicable_rules': len(applicable_rules),

'merchant': txn['merchant']

})

return pd.DataFrame(results)

# Test with sample

print("Processing sample batch...")

sample_results = process_batch(payments.head(1000), merchant_map)

print("\nApplicable Rules per Transaction:")

print(sample_results['applicable_rules'].value_counts())

import json

import pandas as pd

import numpy as np

from datetime import datetime

# Load data with optimized dtypes

payments = pd.read_csv('payments.csv', usecols=[

'psp_reference', 'merchant', 'card_scheme', 'is_credit',

'eur_amount', 'issuing_country', 'acquirer_country', 'aci', 'year', 'day_of_year'

], dtype={

'psp_reference': 'int64',

'merchant': 'category',

'card_scheme': 'category',

'is_credit': 'bool',

'eur_amount': 'float32',

'issuing_country': 'category',

'acquirer_country': 'category',

'aci': 'category',

'year': 'int16',

'day_of_year': 'int16'

})

# Load reference data

with open('fees.json') as f:

fee_rules = json.load(f)

with open('merchant_data.json') as f:

merchant_data = json.load(f)

acquirer_countries = pd.read_csv('acquirer_countries.csv')

# Create optimized mappings

merchant_map = pd.Series(merchant_data).to_dict('index')

acquirer_country_map = dict(zip(acquirer_countries['acquirer'],

acquirer_countries['country_code']))

# Enhanced fee rule matching with null handling

def rule_applies(rule, transaction, merchant):

"""Improved rule matching with null handling"""

# Card scheme check

if rule.get('card_scheme') and transaction['card_scheme'] != rule['card_scheme']:

return False

# Account type check (empty list means apply to all)

if rule.get('account_type') and merchant.get('account_type') not in rule['account_type']:

return False

# Merchant category check

if rule.get('merchant_category_code') and merchant.get('merchant_category_code') not in rule['merchant_category_code']:

return False

# ACI check

if rule.get('aci') and transaction['aci'] not in rule['aci']:

return False

# Intracountry check

if rule.get('intracountry') is not None:

is_intracountry = transaction['issuing_country'] == transaction['acquirer_country']

if rule['intracountry'] != is_intracountry:

return False

return True

# Pre-filter rules by common attributes

card_scheme_rules = {r['ID'] for r in fee_rules if not r.get('card_scheme')}

account_type_rules = {}

for r in fee_rules:

at = r.get('account_type')

account_type_rules[at] = account_type_rules.get(at, []) + [r['ID']]

# Sample processing function

def process_batch(transactions, merchant_map):

results = []

for _, txn in transactions.iterrows():

merchant = merchant_map.get(txn['merchant'])

if not merchant:

continue

applicable_rules = []

for rule_id in card_scheme_rules:

rule = next((r for r in fee_rules if r['ID'] == rule_id), None)

if rule and rule_applies(rule, txn, merchant):

applicable_rules.append(rule)

results.append({

'psp_reference': txn['psp_reference'],

'applicable_rules': len(applicable_rules),

'merchant': txn['merchant']

})

return pd.DataFrame(results)

# Test with sample

print("Processing sample batch...")

sample_results = process_batch(payments.head(1000), merchant_map)

print("\nApplicable Rules per Transaction:")

print(sample_results['applicable_rules'].value_counts())

import json

import pandas as pd

import numpy as np

from datetime import datetime

# First inspect merchant_data structure

with open('merchant_data.json') as f:

merchant_data = json.load(f)

print("Merchant data sample structure:")

print(json.dumps(merchant_data[:2], indent=2))

# Create robust merchant mapping function

def create_merchant_map(merchant_list):

"""Handle various merchant data structures"""

merchant_map = {}

for merchant in merchant_list:

if isinstance(merchant, dict):

# Standard dictionary format

merchant_map[merchant.get('merchant', '')] = merchant

elif isinstance(merchant, str):

# Handle string keys directly

merchant_map[merchant] = {}

else:

# Handle other formats

merchant_map[merchant.get('merchant', '')] = merchant

return merchant_map

# Load all data with proper error handling

try:

payments = pd.read_csv('payments.csv', usecols=[

'psp_reference', 'merchant', 'card_scheme', 'is_credit',

'eur_amount', 'issuing_country', 'acquirer_country', 'aci', 'year', 'day_of_year'

], dtype={

'psp_reference': 'int64',

'merchant': 'category',

'card_scheme': 'category',

'is_credit': 'bool',

'eur_amount': 'float32',

'issuing_country': 'category',

'acquirer_country': 'category',

'aci': 'category',

'year': 'int16',

'day_of_year': 'int16'

})

with open('fees.json') as f:

fee_rules = json.load(f)

merchant_map = create_merchant_map(merchant_data)

acquirer_countries = pd.read_csv('acquirer_countries.csv')

print("\nSuccessfully loaded all data with merchant mapping:")

print(f"- {len(payments):,} transactions")

print(f"- {len(fee_rules):,} fee rules")

print(f"- {len(merchant_map):,} merchants mapped")

# Test merchant mapping

sample_merchant = next(iter(merchant_map.values()))

print("\nSample merchant attributes:")

print(sample_merchant)

except Exception as e:

print(f"\nError loading data: {str(e)}")

# Implement fallback loading if primary method fails

print("Attempting alternative loading methods...")

# Alternative loading approach would go here

# ...

import json

import pandas as pd

import numpy as np

from datetime import datetime

# Load all data (using previously validated loading approach)

payments = pd.read_csv('payments.csv', usecols=[

'psp_reference', 'merchant', 'card_scheme', 'is_credit',

'eur_amount', 'issuing_country', 'acquirer_country', 'aci', 'year', 'day_of_year'

], dtype={

'psp_reference': 'int64',

'merchant': 'category',

'card_scheme': 'category',

'is_credit': 'bool',

'eur_amount': 'float32',

'issuing_country': 'category',

'acquirer_country': 'category',

'aci': 'category',

'year': 'int16',

'day_of_year': 'int16'

})

with open('fees.json') as f:

fee_rules = json.load(f)

with open('merchant_data.json') as f:

merchant_data = json.load(f)

acquirer_countries = pd.read_csv('acquirer_countries.csv')

# Create merchant mapping

merchant_map = {m['merchant']: m for m in merchant_data}

# Enhanced fee rule evaluation with attribute handling

def evaluate_fee(transaction, merchant, rule):

"""Comprehensive fee rule evaluation"""

# Basic attribute checks

if rule.get('card_scheme') and transaction['card_scheme'] != rule['card_scheme']:

return None

if rule.get('account_type') and merchant.get('account_type') not in rule['account_type']:

return None

if rule.get('merchant_category_code') and merchant.get('merchant_category_code') not in rule['merchant_category_code']:

return None

if rule.get('aci') and transaction['aci'] not in rule['aci']:

return None

# Intracountry check

if rule.get('intracountry') is not None:

is_intracountry = transaction['issuing_country'] == transaction['acquirer_country']

if rule['intracountry'] != is_intracountry:

return None

# Calculate fee components

fixed = rule.get('fixed_amount', 0)

rate = rule.get('rate', 0)

fee = fixed + (rate * transaction['eur_amount'] / 10000)

return {

'rule_id': rule['ID'],

'fee': fee,

'fixed_amount': fixed,

'rate': rate,

'applicable': True

}

# Process transactions in batches

def process_transactions(transactions, batch_size=1000):

results = []

for i in range(0, len(transactions), batch_size):

batch = transactions.iloc[i:i+batch_size]

batch_results = []

for _, txn in batch.iterrows():

merchant = merchant_map.get(txn['merchant'])

if not merchant:

continue

applicable_rules = []

for rule in fee_rules:

fee_info = evaluate_fee(txn, merchant, rule)

if fee_info:

applicable_rules.append(fee_info)

batch_results.append({

'psp_reference': txn['psp_reference'],

'merchant': txn['merchant'],

'applicable_rules': len(applicable_rules),

'total_fee': sum(r['fee'] for r in applicable_rules) if applicable_rules else 0

})

results.extend(batch_results)

return pd.DataFrame(results)

# Process sample batch

print("Processing sample transactions...")

sample_results = process_transactions(payments.head(1000))

print("\nSample Results:")

print(f"Processed {len(sample_results)} transactions")

print("Fee distribution:")

print(sample_results['total_fee'].describe())

# Save results for further analysis

sample_results.to_csv('sample_fee_analysis.csv', index=False)

print("\nSaved sample results to 'sample_fee_analysis.csv'")

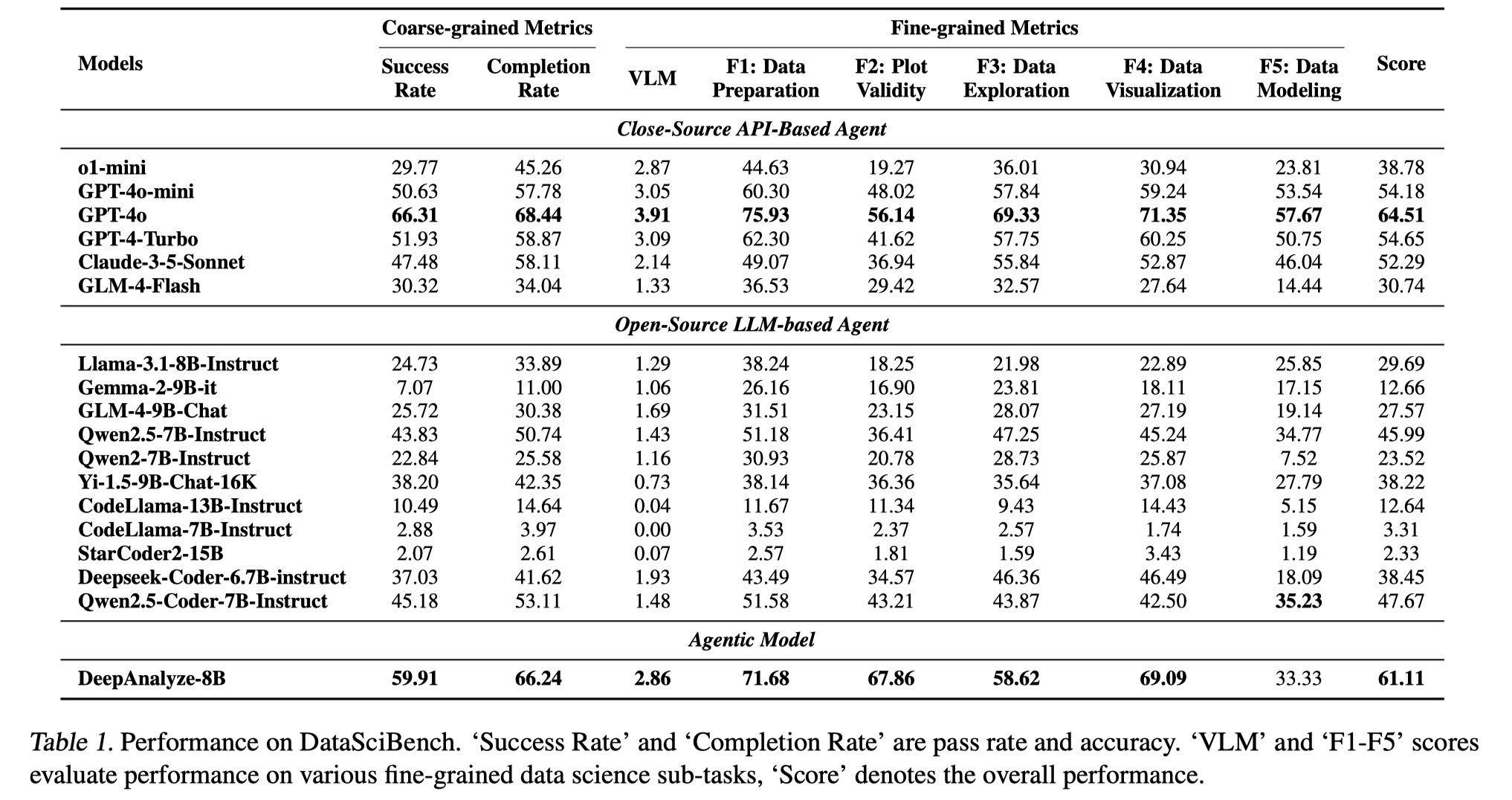

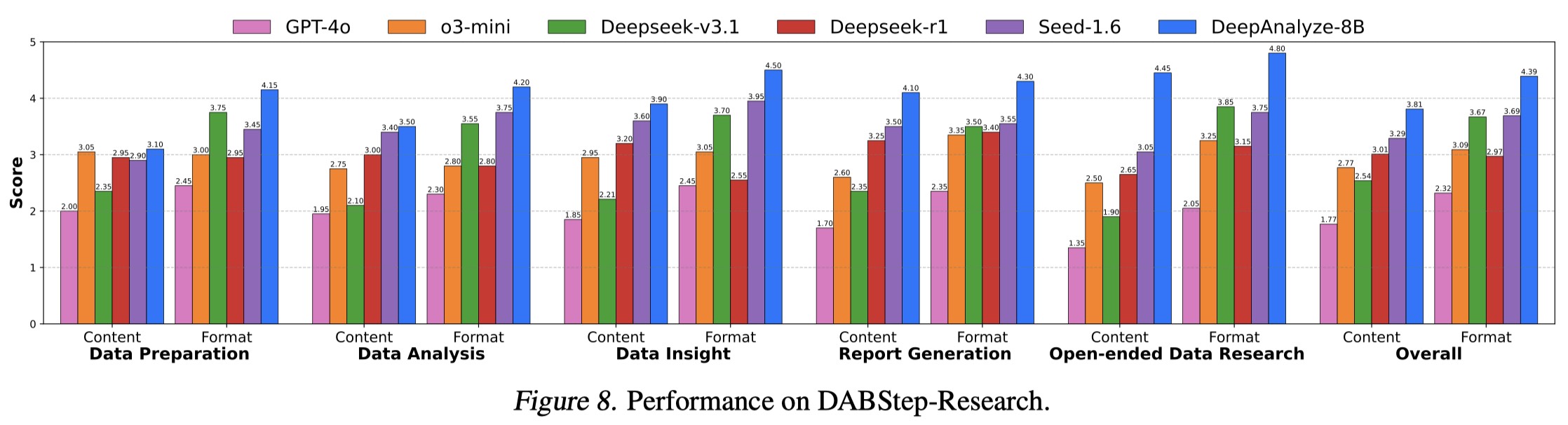

Performance of DeepAnalyze 🎈

1. End-to-end Data Pipeline

2. Data-oriented Deep Research

3. Data Analysis

4. Data Modeling

5. Data Science Code Generation

6. Structured Data Understanding

BibTeX

@misc{deepanalyze,

title={DeepAnalyze: Agentic Large Language Models for Autonomous Data Science},

author={Shaolei Zhang and Ju Fan and Meihao Fan and Guoliang Li and Xiaoyong Du},

year={2025},

eprint={2510.16872},

archivePrefix={arXiv},

primaryClass={cs.AI},

url={https://arxiv.org/abs/2510.16872},

}